SPOILER ALERT!

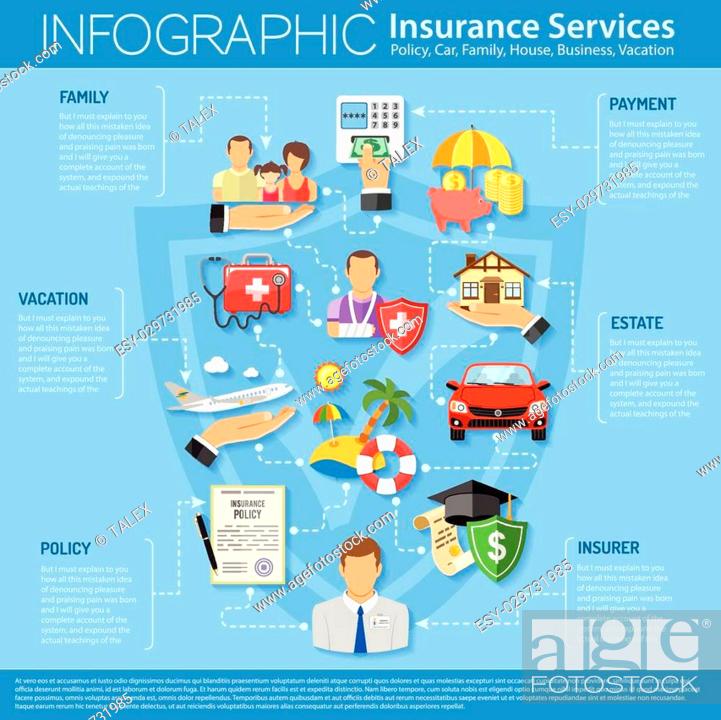

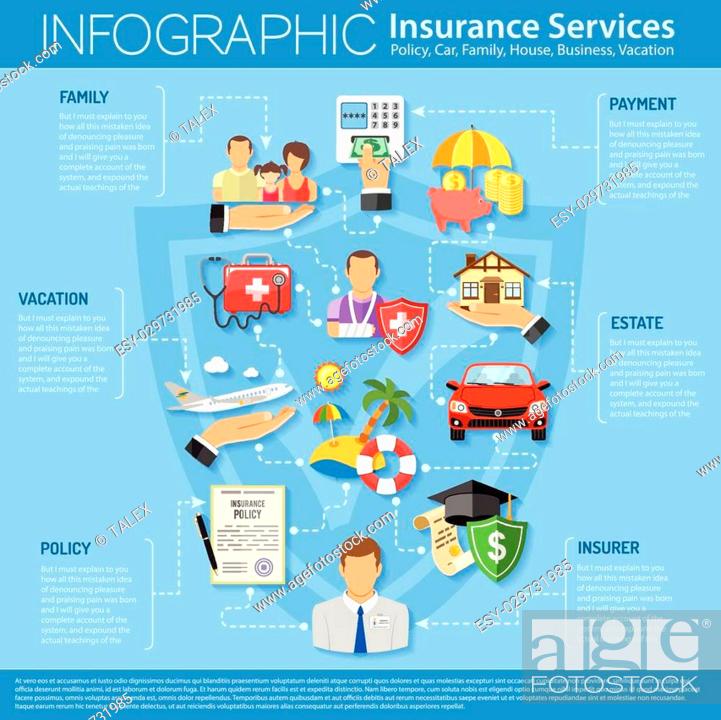

Explore The Intricacies Of Insurance Policy Terms With The Assistance Of Skilled Agents, Unlocking Essential Insights That Enable Informed Decision-Making-- Do Not Miss This Equipping Source

Web Content Composed By-Copeland Bishop

When dealing with the labyrinth of insurance terms, have you found yourself puzzled by deductibles, costs, or copays? Knowledgeable agents provide clarity on these essential components, streamlining the complex language that frequently leaves individuals perplexed. By unraveling the details of responsibility, residential or commercial property, and extensive protection, this overview furnishes you with the knowledge required to browse the insurance landscape effectively. Stay tuned to find just how breaking down insurance coverage lingo can encourage you to make educated choices and secure the best insurance coverage for your needs.

Browsing insurance coverage can end up being easier once you grasp the definitions behind usual insurance terms. Understanding visit the next page is key to making notified choices about your coverage. Deductible, for instance, is the amount you pay out of pocket before your insurance policy starts. Premiums, on the other hand, are the normal settlements you make to your insurer to maintain protection. Understanding the difference in between these terms can assist you choose a policy that fits your needs and budget plan.

Another important term to understand is copay, which is a fixed amount you spend for covered services. It's important to know what services call for a copay to prevent unanticipated costs. Additionally, the term 'out-of-pocket optimum' describes the most you'll have to pay for protected services in a policy duration. This limitation can give financial defense and assurance in case of unforeseen medical expenditures. By familiarizing yourself with these terms, you can navigate insurance policies with confidence and clearness.

Comprehending common insurance coverage terms is the initial step towards efficiently reviewing various policy protection alternatives available to you. When you grasp the terminology, browsing plan insurance coverage alternatives becomes even more workable.

When thinking about insurance policies, pay attention to the sorts of coverage supplied. Obligation insurance coverage secures you if you're responsible for injuries or problems to others. Residential property protection aids replace or fix your items in case of burglary, fire, or other protected events. Furthermore, take into consideration detailed coverage for a broader variety of protection, including non-collision occurrences like burglary or natural calamities.

When picking plan insurance coverage choices, examine your needs thoroughly. Consider your budget plan, way of living, and possible dangers you might deal with. Tailoring your coverage to suit your certain scenarios guarantees you're effectively shielded without overpaying for unnecessary functions. By comprehending your choices and choosing wisely, you can secure a plan that supplies the ideal degree of defense for you.

To realize insurance lingo efficiently, familiarize on your own with crucial terms utilized in plan insurance coverage discussions. Start by understanding the difference between costs and insurance deductible. The costs is the amount you pay for your insurance coverage, typically on a month-to-month or annual basis. The deductible is the amount you should pay out of pocket prior to your insurance kicks in to cover the rest.

An additional essential term is protection restriction, which describes the maximum amount your insurance policy supplier will spend for a covered loss. Knowing these terms will certainly assist you browse plan choices with confidence.

Additionally, inform have a peek at this website on common insurance policy kinds like responsibility, comprehensive, and crash insurance coverage. Obligation insurance coverage aids shield you economically if you're discovered in charge of harming somebody or harming their building. Comprehensive insurance coverage commonly covers damages to your lorry from events besides crashes, such as theft or criminal damage. Crash coverage, on the other hand, aids spend for repair services to your car if you're involved in an accident with an additional automobile or things.

Verdict

You now have the expertise and tools to confidently analyze insurance coverage jargon and make informed decisions concerning your insurance coverage.

By comprehending typical terms and browsing plan options, you can make sure that you have the right insurance coverage for your details demands.

Bear in mind to always ask inquiries and look for clarification from experienced agents to fully understand your plan and protect yourself from unexpected surprises.

When dealing with the labyrinth of insurance terms, have you found yourself puzzled by deductibles, costs, or copays? Knowledgeable agents provide clarity on these essential components, streamlining the complex language that frequently leaves individuals perplexed. By unraveling the details of responsibility, residential or commercial property, and extensive protection, this overview furnishes you with the knowledge required to browse the insurance landscape effectively. Stay tuned to find just how breaking down insurance coverage lingo can encourage you to make educated choices and secure the best insurance coverage for your needs.

Common Insurance Terms Explained

Browsing insurance coverage can end up being easier once you grasp the definitions behind usual insurance terms. Understanding visit the next page is key to making notified choices about your coverage. Deductible, for instance, is the amount you pay out of pocket before your insurance policy starts. Premiums, on the other hand, are the normal settlements you make to your insurer to maintain protection. Understanding the difference in between these terms can assist you choose a policy that fits your needs and budget plan.

Another important term to understand is copay, which is a fixed amount you spend for covered services. It's important to know what services call for a copay to prevent unanticipated costs. Additionally, the term 'out-of-pocket optimum' describes the most you'll have to pay for protected services in a policy duration. This limitation can give financial defense and assurance in case of unforeseen medical expenditures. By familiarizing yourself with these terms, you can navigate insurance policies with confidence and clearness.

Navigating Policy Insurance Coverage Options

Comprehending common insurance coverage terms is the initial step towards efficiently reviewing various policy protection alternatives available to you. When you grasp the terminology, browsing plan insurance coverage alternatives becomes even more workable.

When thinking about insurance policies, pay attention to the sorts of coverage supplied. Obligation insurance coverage secures you if you're responsible for injuries or problems to others. Residential property protection aids replace or fix your items in case of burglary, fire, or other protected events. Furthermore, take into consideration detailed coverage for a broader variety of protection, including non-collision occurrences like burglary or natural calamities.

When picking plan insurance coverage choices, examine your needs thoroughly. Consider your budget plan, way of living, and possible dangers you might deal with. Tailoring your coverage to suit your certain scenarios guarantees you're effectively shielded without overpaying for unnecessary functions. By comprehending your choices and choosing wisely, you can secure a plan that supplies the ideal degree of defense for you.

Tips for Understanding Insurance Policy Jargon

To realize insurance lingo efficiently, familiarize on your own with crucial terms utilized in plan insurance coverage discussions. Start by understanding the difference between costs and insurance deductible. The costs is the amount you pay for your insurance coverage, typically on a month-to-month or annual basis. The deductible is the amount you should pay out of pocket prior to your insurance kicks in to cover the rest.

An additional essential term is protection restriction, which describes the maximum amount your insurance policy supplier will spend for a covered loss. Knowing these terms will certainly assist you browse plan choices with confidence.

Additionally, inform have a peek at this website on common insurance policy kinds like responsibility, comprehensive, and crash insurance coverage. Obligation insurance coverage aids shield you economically if you're discovered in charge of harming somebody or harming their building. Comprehensive insurance coverage commonly covers damages to your lorry from events besides crashes, such as theft or criminal damage. Crash coverage, on the other hand, aids spend for repair services to your car if you're involved in an accident with an additional automobile or things.

Verdict

You now have the expertise and tools to confidently analyze insurance coverage jargon and make informed decisions concerning your insurance coverage.

By comprehending typical terms and browsing plan options, you can make sure that you have the right insurance coverage for your details demands.

Bear in mind to always ask inquiries and look for clarification from experienced agents to fully understand your plan and protect yourself from unexpected surprises.