SPOILER ALERT!

Discovering The Appropriate Insurance Broker For Your Requirements

Written By-Krause Hays

When it comes to insurance coverage, did you understand that 48% of local business in the USA have never had insurance coverage?

Finding the right insurance broker for your demands can be a vital decision that affects your economic safety and security and comfort.

With many options readily available, navigating the globe of insurance can be frustrating.

Understanding how to choose the ideal broker that recognizes your one-of-a-kind demands and supplies the very best coverage can make all the distinction.

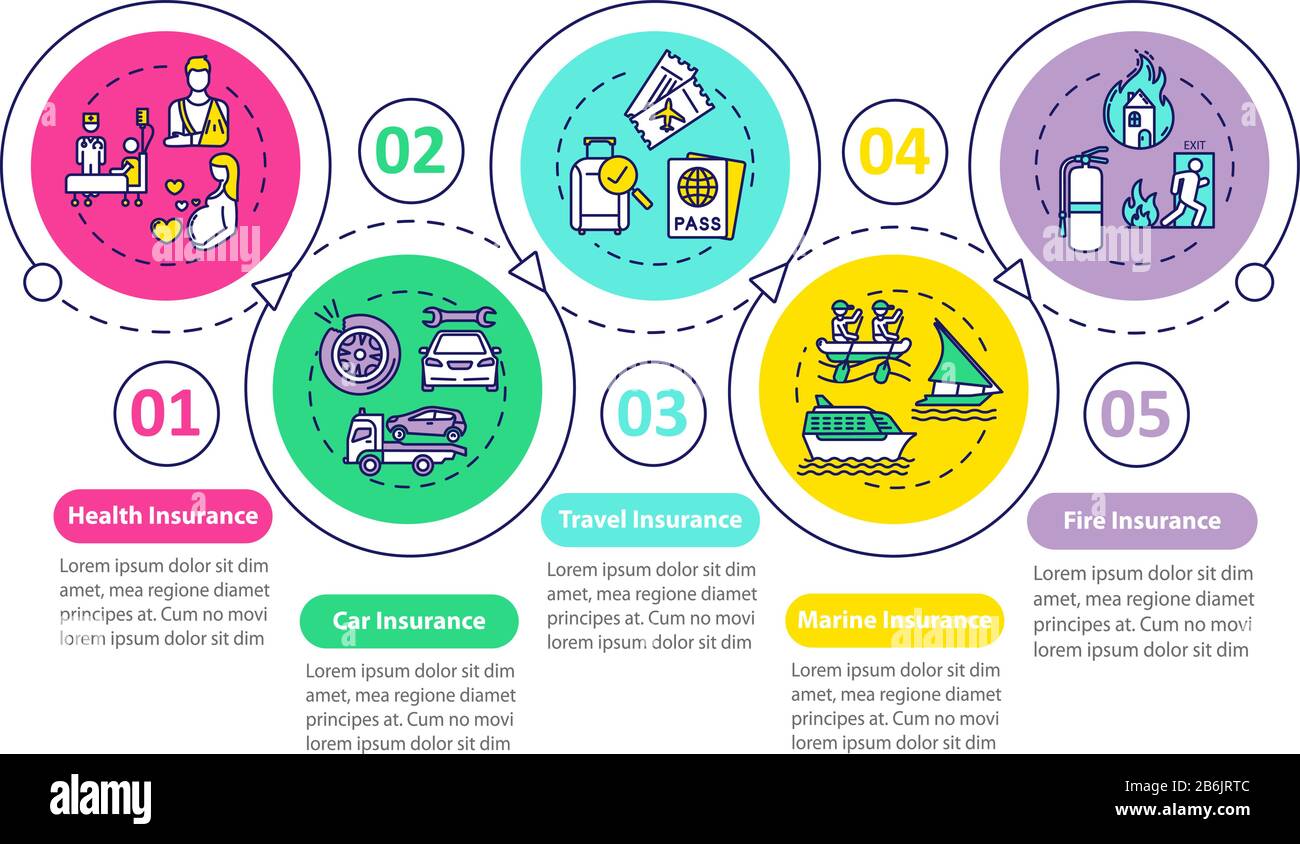

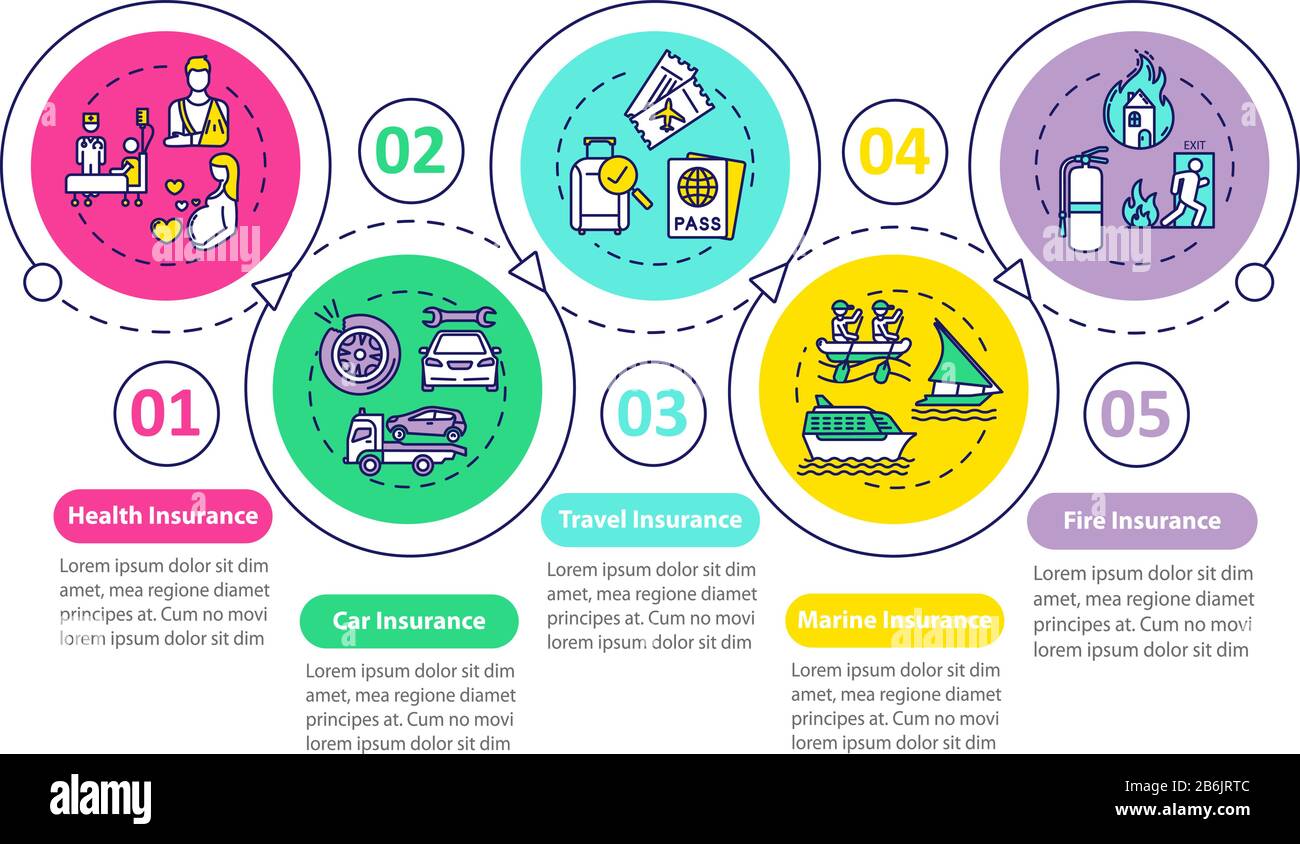

Prior to selecting an insurance coverage broker, it's critical to completely examine your details needs and economic scenario. Make the effort to examine what type of coverage you need and how much you can manage to pay in premiums.

https://blogfreely.net/wilmer901marketta/insurance-policy-firm-whatever-you-need-to-know-before-deciding to identify their experience in the areas that matter most to you, whether it's health, car, home, or life insurance. Consider their online reputation, customer reviews, and any type of issues lodged against them.

It's additionally vital to inquire about the variety of policies they provide and contrast rates to guarantee you're getting the most effective value for your money. By being diligent in your evaluation, you can make an enlightened choice that fulfills your insurance requires effectively.

To properly analyze an insurance broker, take into consideration initiating your examination by examining their track record, knowledge, and client feedback. Start by assessing mouse click the next article , sector understanding, and client satisfaction levels.

Below are some actions to aid you extensively assess an insurance policy broker:

- ** Examine Performance History: ** Check out their history of successful insurance positionings.

- ** Assess Experience: ** Review their expertise in the type of insurance policy you require.

- ** Evaluation Client Comments: ** Review reviews and testimonials from previous customers.

- ** Confirm Credentials: ** Guarantee they're certified and affiliated with trustworthy insurance policy service providers.

- ** Interview Personally: ** Set up a meeting to review your requirements and evaluate their professionalism and reliability.

Make sure that your choice is informed by completely investigating multiple insurance policy brokers in your area. Beginning by inspecting their qualifications and licenses to run. Verify https://blogfreely.net/earle764kerry/leveraging-social-network-to-boost-your-insurance-coverage-representative and competence in managing insurance needs comparable to yours. Read customer evaluations and reviews to gauge consumer satisfaction degrees. Look for suggestions from buddies, family members, or associates that've had positive experiences with insurance policy brokers.

Contrast the solutions offered, consisting of the series of insurance policy products they supply and their prices structures. Search for brokers who interact clearly, pay attention diligently to your requirements, and are receptive to your questions. Depend on your reactions and select a broker that makes you really feel comfy and certain in their capacities to assist you properly.

Verdict

So, now you have all the devices to find the ideal insurance coverage broker for your needs. Bear in mind to trust your digestive tract, do your research, and ask the appropriate questions.

Don't settle for the first option you come across; see to it to explore all your choices. In the long run, it's much better to be safe than sorry.

Satisfied searching!

When it comes to insurance coverage, did you understand that 48% of local business in the USA have never had insurance coverage?

Finding the right insurance broker for your demands can be a vital decision that affects your economic safety and security and comfort.

With many options readily available, navigating the globe of insurance can be frustrating.

Understanding how to choose the ideal broker that recognizes your one-of-a-kind demands and supplies the very best coverage can make all the distinction.

Factors to Consider Before Choosing

Prior to selecting an insurance coverage broker, it's critical to completely examine your details needs and economic scenario. Make the effort to examine what type of coverage you need and how much you can manage to pay in premiums.

https://blogfreely.net/wilmer901marketta/insurance-policy-firm-whatever-you-need-to-know-before-deciding to identify their experience in the areas that matter most to you, whether it's health, car, home, or life insurance. Consider their online reputation, customer reviews, and any type of issues lodged against them.

It's additionally vital to inquire about the variety of policies they provide and contrast rates to guarantee you're getting the most effective value for your money. By being diligent in your evaluation, you can make an enlightened choice that fulfills your insurance requires effectively.

Steps to Examine Insurance Policy Broker

To properly analyze an insurance broker, take into consideration initiating your examination by examining their track record, knowledge, and client feedback. Start by assessing mouse click the next article , sector understanding, and client satisfaction levels.

Below are some actions to aid you extensively assess an insurance policy broker:

- ** Examine Performance History: ** Check out their history of successful insurance positionings.

- ** Assess Experience: ** Review their expertise in the type of insurance policy you require.

- ** Evaluation Client Comments: ** Review reviews and testimonials from previous customers.

- ** Confirm Credentials: ** Guarantee they're certified and affiliated with trustworthy insurance policy service providers.

- ** Interview Personally: ** Set up a meeting to review your requirements and evaluate their professionalism and reliability.

Tips for Making the Right Choice

Make sure that your choice is informed by completely investigating multiple insurance policy brokers in your area. Beginning by inspecting their qualifications and licenses to run. Verify https://blogfreely.net/earle764kerry/leveraging-social-network-to-boost-your-insurance-coverage-representative and competence in managing insurance needs comparable to yours. Read customer evaluations and reviews to gauge consumer satisfaction degrees. Look for suggestions from buddies, family members, or associates that've had positive experiences with insurance policy brokers.

Contrast the solutions offered, consisting of the series of insurance policy products they supply and their prices structures. Search for brokers who interact clearly, pay attention diligently to your requirements, and are receptive to your questions. Depend on your reactions and select a broker that makes you really feel comfy and certain in their capacities to assist you properly.

Verdict

So, now you have all the devices to find the ideal insurance coverage broker for your needs. Bear in mind to trust your digestive tract, do your research, and ask the appropriate questions.

Don't settle for the first option you come across; see to it to explore all your choices. In the long run, it's much better to be safe than sorry.

Satisfied searching!