Impressive Insurance Coverage Advice You Never Understood You Needed

Authored by-Mcclain Woods

Insurance, no matter what kind, is just one of those costs that you don't want to incur, but know you have to. However, that doesn't mean that Liability Insurance Policy have to spend the most money for a suitable policy, no matter what type of insurance you are shopping for. With these tips, you can find reasonable rates that suit you just right.

If you want to make sure you are getting the best deal on your insurance premiums, make sure that your credit score is as good. A negative credit score or mark on your credit report can put you into a different pricing structure and cost you money on a monthly or yearly basis.

When traveling, https://economictimes.indiatimes.com/wealth/insure/cost-of-different-types-of-medical-insurance-policies-that-you-need-for-full-health-cover/articleshow/66782666.cms should always consider purchasing insurance with your package. It will only cost a few dollars more, and it will cover you in case you have an accident, or if something unexpected were to happen. It is better to be safe than sorry and you don't want to lose out.

When involved in an insurance claim, always be as professional as possible. The people you are working with are people too, and you will see much more positive results if you are positive and professional. Your insurance company only wants to know the facts, not the emotions. Proofread all written material sent to them.

If you are looking to save money on insurance your best bet is to stick with one company. https://www.dailystrength.org/journals/obtaining-rental-insurance-coverage-is-no-more-a-challenging-pro wonder from company to company accumulating little savings here and there. However, most insurance companies offer loyalty savings where long term customers get hefty discounts. This also looks good on your credit report.

If you keep good records, it will make the entire claim process easier. If you speak with an insurance company representative regarding your claim, make a note of the person's name and the date on which you spoke with that person. With each conversation you have, whether it's over the phone or face to face, follow up with a written letter as confirmation.

Customer service is an important consideration regarding insurance companies as you have to deal with them in emergencies. Find out what others think of your prospective insurer. If you are on the market for home owner insurance you can visit J. D. Power's website where consumers can rate the insurance companies.

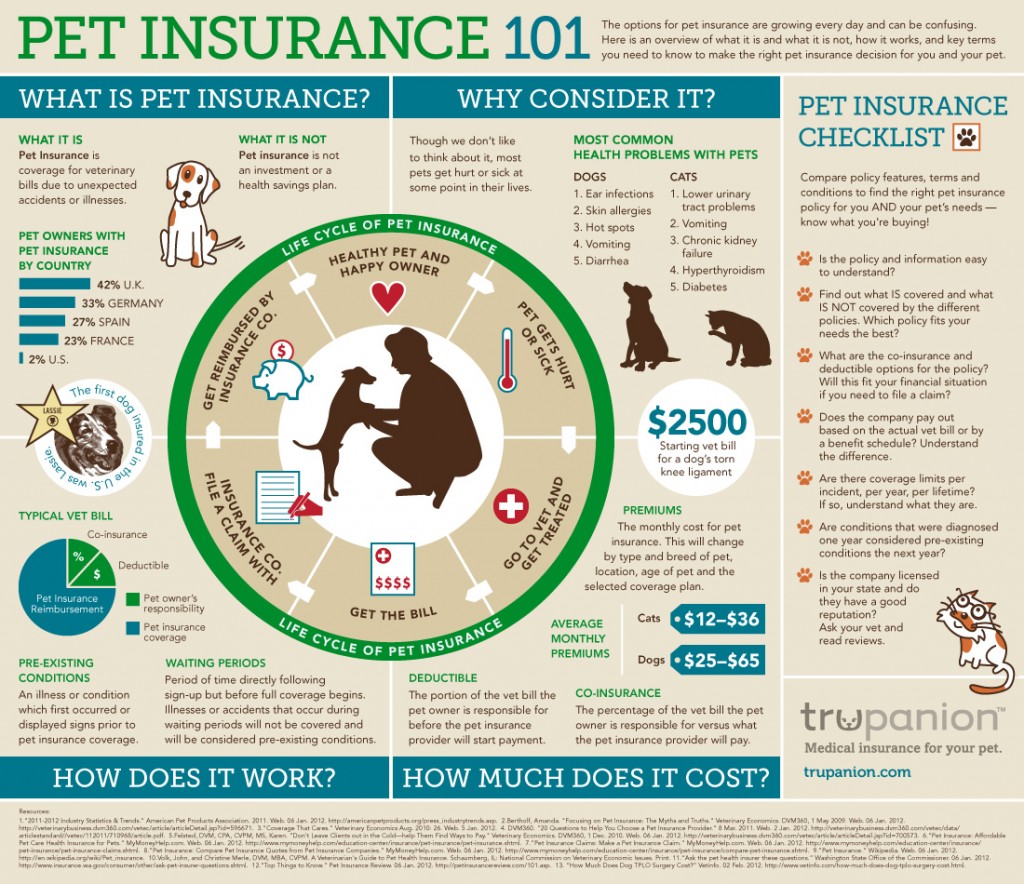

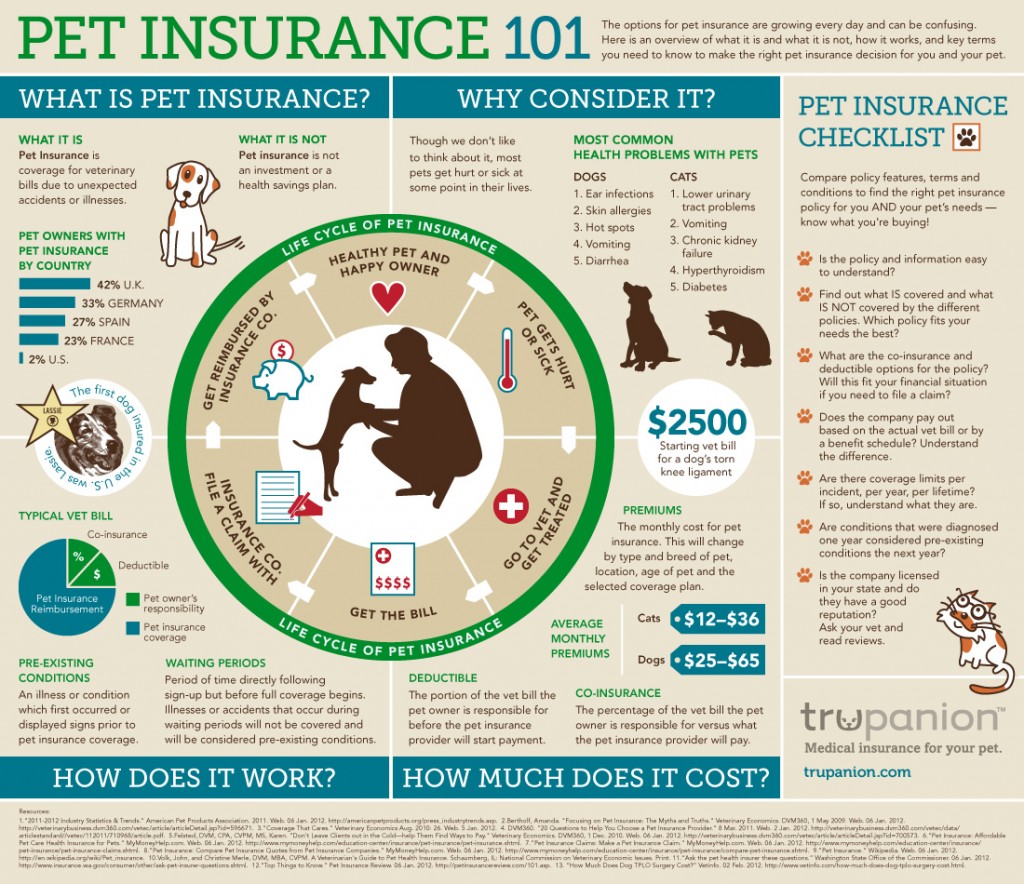

Make sure that your pet insurance representatives are familiar with animals. You do not want someone handling your pet's claim if they do not even know what a Pomeranian is. Before you purchase your policy, you may want to call and speak to one of their claims workers, and quiz them on what they really know.

Check with the company that you get your other insurances from, like rental insurance and life, to see if they offer a policy for car insurance. Most companies will offer you a discount for purchasing multiple policies from them. It may not be the cheapest option so you still need to get quotes from elsewhere to be sure.

Pet insurance can save you a ton of money in veterinary bills. Pets need health care, too. Animals can get sick and the costs can be too much at once for the average person. Health insurance for your pet can afford them the treatment that they need at that very moment they need it, while not making money an issue in the treatment plan.

If possible, purchase as much of your insurance from a single company to obtain applicable discounts. Many carriers offer significant premium reductions for customers purchasing multiple lines of insurance such as bundling home, car and life insurance. If a specific insurance company meets your needs, keeping your policies with one carrier can save you quite a bit of money.

Check your pet's insurance policy for information on the company requirements. Some policies require you to take your pet to the vet for a yearly check up, and pay out of pocket for it. Yearly physical exams are a great idea for pet care, but make sure the insurance company isn't forcing you to pay for it.

Keeping your credit report clean will also reduce the amount you pay on insurance. Your premiums are based on how much of a risk you appear to be to the insurance company, and not paying your debts can make you look like a deadbeat. If you pay off everything you owe, you will quickly find your premiums go down as a result.

Sometimes, insuring a pet can be a great way to be sure that you will have enough money to take care of that pet if an illness occurs or maybe, some other kind of accident. The insurance will cover the expensive surgery, medicine or other veterinary bills, saving you money.

If you are consolidating your insurance policies, make sure you're approaching this as wisely as possible. There is a good chance that you will inadvertently, create areas of insurance overlap or gaps in coverage. Consult a broker to assist you if you're not sure how to group things together to save money.

When your car gets towed away, due to an accident or parking dispute, get it out of the yard as fast as you can. Leaving your car there for an extended period of time will cause the fees to increase daily, and your insurance company will not pay for that.

Get quotes from various sources and companies before finally choosing an insurance policy. There are discounts you can get online instead of going through a broker or agent. Make sure to get a quote from different places, don't stick to one.

There are so many reasons why you need insurance. There is not one person who would not benefit from some type of insurance policy, whether it is life, health, dental, or some other type. Insurance has a great place in this world, as it allows us to afford the things we need the most, when we need them the most.

WIth all the tips that were presented here in the article you should now be feeling more confident in the type of insurance you want to purchase. You always want to keep up to date when it comes to a subject like insurance so you are always making the correct decisions.

Insurance, no matter what kind, is just one of those costs that you don't want to incur, but know you have to. However, that doesn't mean that Liability Insurance Policy have to spend the most money for a suitable policy, no matter what type of insurance you are shopping for. With these tips, you can find reasonable rates that suit you just right.

If you want to make sure you are getting the best deal on your insurance premiums, make sure that your credit score is as good. A negative credit score or mark on your credit report can put you into a different pricing structure and cost you money on a monthly or yearly basis.

When traveling, https://economictimes.indiatimes.com/wealth/insure/cost-of-different-types-of-medical-insurance-policies-that-you-need-for-full-health-cover/articleshow/66782666.cms should always consider purchasing insurance with your package. It will only cost a few dollars more, and it will cover you in case you have an accident, or if something unexpected were to happen. It is better to be safe than sorry and you don't want to lose out.

When involved in an insurance claim, always be as professional as possible. The people you are working with are people too, and you will see much more positive results if you are positive and professional. Your insurance company only wants to know the facts, not the emotions. Proofread all written material sent to them.

If you are looking to save money on insurance your best bet is to stick with one company. https://www.dailystrength.org/journals/obtaining-rental-insurance-coverage-is-no-more-a-challenging-pro wonder from company to company accumulating little savings here and there. However, most insurance companies offer loyalty savings where long term customers get hefty discounts. This also looks good on your credit report.

If you keep good records, it will make the entire claim process easier. If you speak with an insurance company representative regarding your claim, make a note of the person's name and the date on which you spoke with that person. With each conversation you have, whether it's over the phone or face to face, follow up with a written letter as confirmation.

Customer service is an important consideration regarding insurance companies as you have to deal with them in emergencies. Find out what others think of your prospective insurer. If you are on the market for home owner insurance you can visit J. D. Power's website where consumers can rate the insurance companies.

Make sure that your pet insurance representatives are familiar with animals. You do not want someone handling your pet's claim if they do not even know what a Pomeranian is. Before you purchase your policy, you may want to call and speak to one of their claims workers, and quiz them on what they really know.

Check with the company that you get your other insurances from, like rental insurance and life, to see if they offer a policy for car insurance. Most companies will offer you a discount for purchasing multiple policies from them. It may not be the cheapest option so you still need to get quotes from elsewhere to be sure.

Pet insurance can save you a ton of money in veterinary bills. Pets need health care, too. Animals can get sick and the costs can be too much at once for the average person. Health insurance for your pet can afford them the treatment that they need at that very moment they need it, while not making money an issue in the treatment plan.

If possible, purchase as much of your insurance from a single company to obtain applicable discounts. Many carriers offer significant premium reductions for customers purchasing multiple lines of insurance such as bundling home, car and life insurance. If a specific insurance company meets your needs, keeping your policies with one carrier can save you quite a bit of money.

Check your pet's insurance policy for information on the company requirements. Some policies require you to take your pet to the vet for a yearly check up, and pay out of pocket for it. Yearly physical exams are a great idea for pet care, but make sure the insurance company isn't forcing you to pay for it.

Keeping your credit report clean will also reduce the amount you pay on insurance. Your premiums are based on how much of a risk you appear to be to the insurance company, and not paying your debts can make you look like a deadbeat. If you pay off everything you owe, you will quickly find your premiums go down as a result.

Sometimes, insuring a pet can be a great way to be sure that you will have enough money to take care of that pet if an illness occurs or maybe, some other kind of accident. The insurance will cover the expensive surgery, medicine or other veterinary bills, saving you money.

If you are consolidating your insurance policies, make sure you're approaching this as wisely as possible. There is a good chance that you will inadvertently, create areas of insurance overlap or gaps in coverage. Consult a broker to assist you if you're not sure how to group things together to save money.

When your car gets towed away, due to an accident or parking dispute, get it out of the yard as fast as you can. Leaving your car there for an extended period of time will cause the fees to increase daily, and your insurance company will not pay for that.

Get quotes from various sources and companies before finally choosing an insurance policy. There are discounts you can get online instead of going through a broker or agent. Make sure to get a quote from different places, don't stick to one.

There are so many reasons why you need insurance. There is not one person who would not benefit from some type of insurance policy, whether it is life, health, dental, or some other type. Insurance has a great place in this world, as it allows us to afford the things we need the most, when we need them the most.

WIth all the tips that were presented here in the article you should now be feeling more confident in the type of insurance you want to purchase. You always want to keep up to date when it comes to a subject like insurance so you are always making the correct decisions.